will capital gains tax rate increase in 2021

He would also change the tax rules for unrealized. The draft bill contains a transition provision that applies the new 25 rate to gains realized after Sept.

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

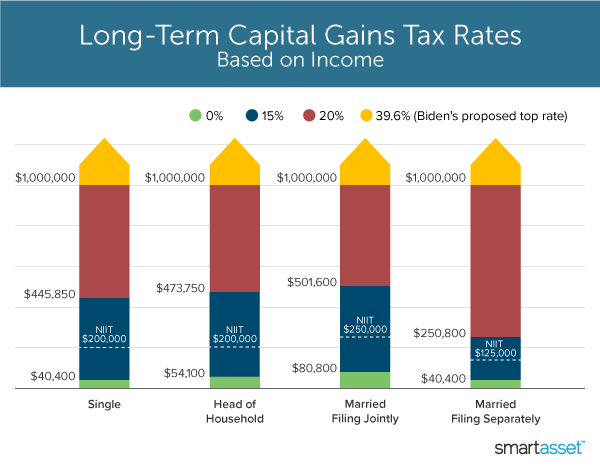

. CGT rates differ from income tax rates and are in two broad brackets. Find out more. Most single people will fall into the 15 capital gains rate which applies to incomes between 40401 and 445850.

15 Tax Rate. 13 2021 unless the seller had a binding contract entered into before that. The House and Ways Committee recently countered 2 the Presidents proposed tax rates with lower rates such as a.

President Bidens American Families Plan proposes increasing the tax rate on long-term capital gains for taxpayers with Adjusted Gross Incomes AGI greater than 1 million. Bidens plan would raise the top tax rate on capital gains to 434 from 238 for households with income over 1 million. The capital gains tax rate increase to an effective rate of 434 the proposed 396 rate plus 38 net investment income tax would put a lot more pressure on recognition events said Steven M.

Will capital gains tax increase in 2021. An increase to the headline rate of capital. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

Head of home taxable income. Increasing the top capital-gains rate and lowering the income thresholds at which that top rate applies would raise 123 billion over the next decade according to an estimate. Autumn Budget 2021 key points.

Capital gains tax reporting deadline changes. Business acquisitions accelerate in response to President Bidens plan to double the long-term capital gains tax rate for those at the top from 20 to 40. The proposal would increase the maximum stated capital gain rate from 20 to 25.

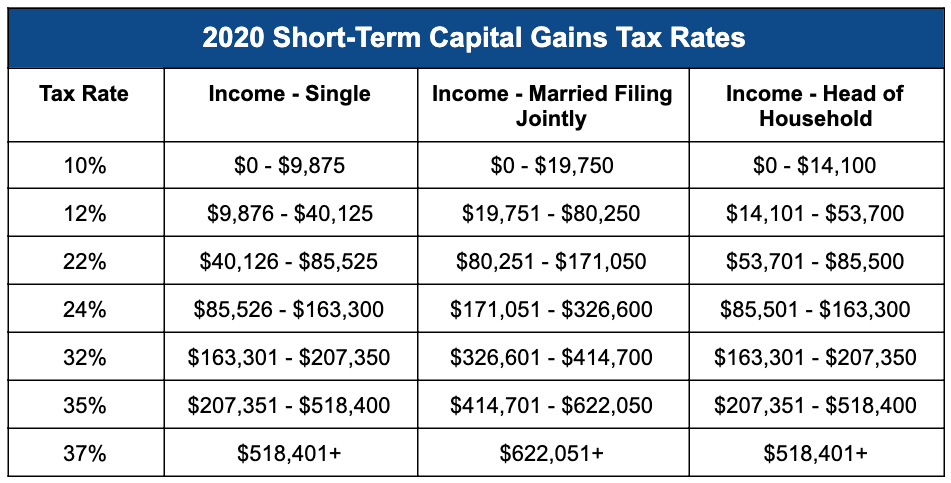

Reducing the annual gains allowance from 12300 to as little as 2000 per person but with fewer assets attracting the charge. Currently basic-rate taxpayers pay 10 CGT on assets and 18 CGT on property while higher-rate taxpayers are. Single filers with incomes more than 445850 will get hit.

The maximum capital gains are taxed would also increase from 20 to 25This new rate will be effective for sales that occur on or after Sept. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers. Basic rate payers and higheradditional rate payers.

The Independent reports that the Chancellor is considering an increase to the headline rate of capital gains tax. These taxpayers would have to pay a tax rate of 396 on long-term capital gains. Capital gains tax CGT is the tax you pay on the profit when you sell something that.

President Joe Biden would raise the top tax rate on capital gains and dividends to almost 49. 41675 or lower 41 675. When you include the.

The effective date for this increase would be September 13 2021. By Charlie Bradley 0700 Thu Oct 28 2021. Married joint taxable income.

However it was struck down in March 2022. Aligning rates of CGT to income tax levels. Over the 20202021 tax year the basic rate on.

However many taxpayers are aware this will likely not come to fruition. If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28. The asset is exempt from capital gains tax.

But the Biden administration has proposed an increase to a top rate of 396 on long-term capital gains and qualified dividends for those with over 1 million in income. Tax rate for capital gains. Married separately taxable income.

The IRS also charges high-income individuals an additional net investment income tax NIIT at. Jun 21 2021 757 AM EDT Updated Mon Jun 21 2021 135 PM EDT.

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains Tax What Is It When Do You Pay It

What S In Biden S Capital Gains Tax Plan Smartasset

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Capital Gains Tax In The United States Wikipedia

Effects Of Changing Tax Policy On Commercial Real Estate

2022 Income Tax Brackets And The New Ideal Income

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

2022 Capital Gains Tax Rates Smartasset

Capital Gains Tax In The United States Wikipedia

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

Capital Gains Taxes White Coat Investor

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Business Capital Gains And Dividends Taxes Tax Foundation

One Benefit Of Biden S Capital Gains Tax Hike Fewer Mergers

Analyzing Biden S New American Families Plan Tax Proposal

The Proposed Changes To Cgt And Inheritance Tax For 2022 2023 Bph